Table of Contents

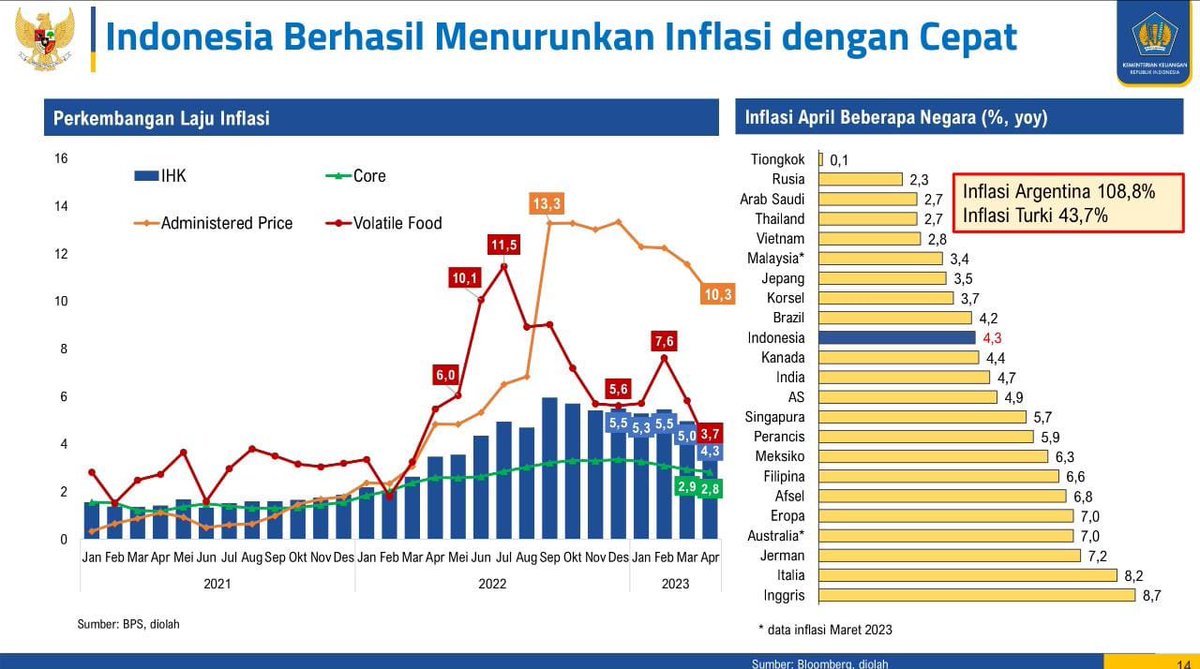

- Prastowo Yustinus on Twitter: "6. Berhasil menurunkan inflasi dengan ...

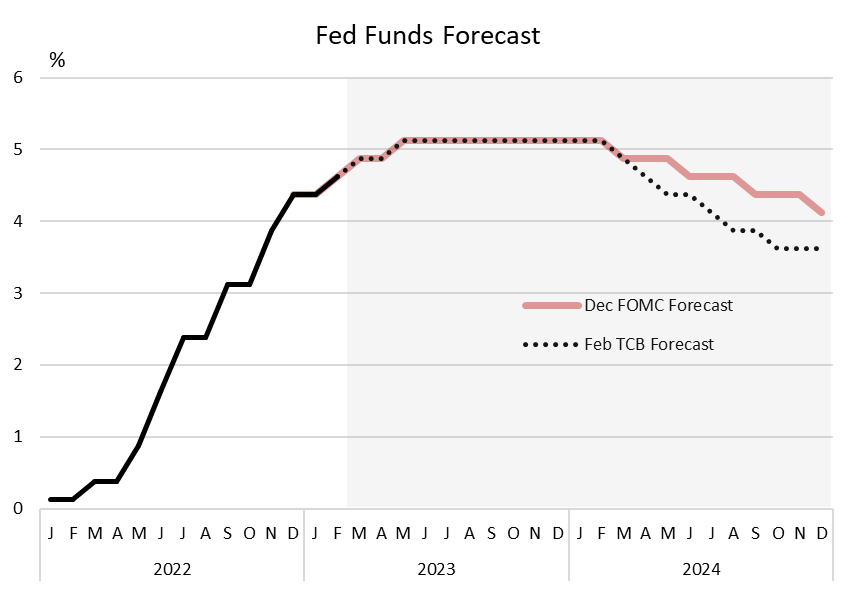

- Apakah The Fed Akan Pangkas Suku Bunga? Ini Prediksinya untuk 2024 ...

- Market Outlook 2024: Fed Unlikely to Cut Rates by 75 bps Marcellus ...

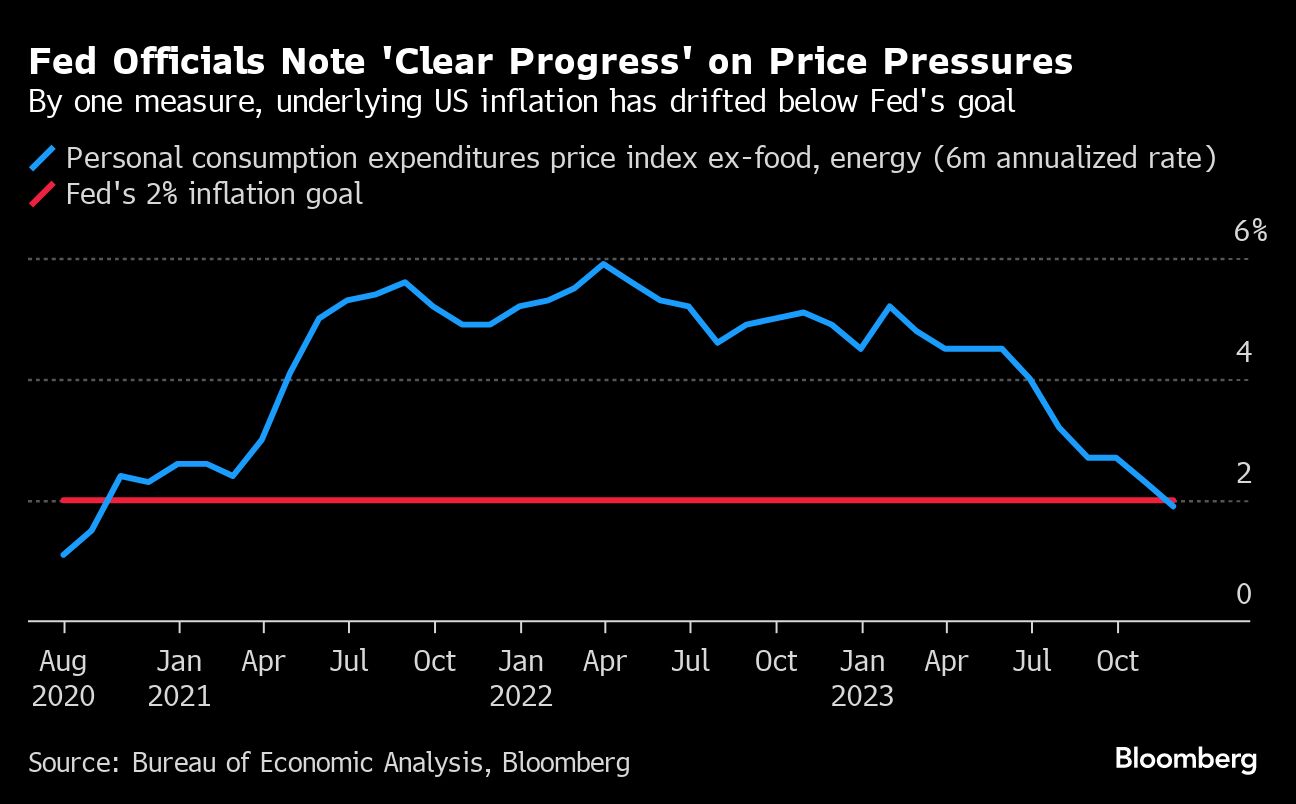

- The Fed Beri Sinyal Kebijakan Moneter Ketat hingga Inflasi Mereda ...

- Fed Rate 2024 Forecast - Halie Karalee

- Inflasi Bisa Terus Terjadi Hingga 2024

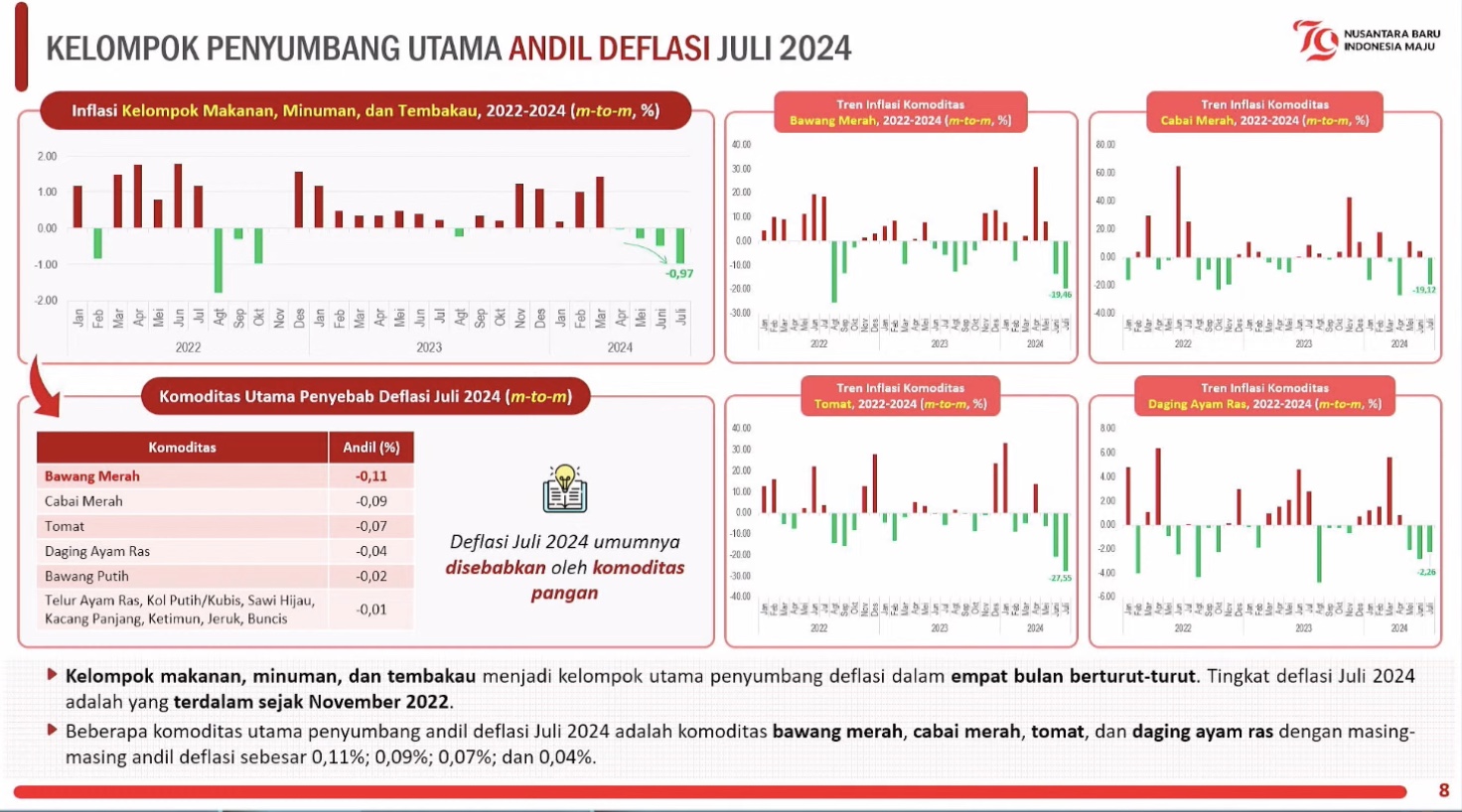

- Indonesia Deflasi 0,18 Persen Juli 2024, Makanan hingga Tembakau jadi ...

- Fed 'dot plot' shows central bank will cut interest rates by 0.75% in 2024

- Fed Holds Interest Rates Steady—And Signals Just One Cut In 2024

- Fed rate cuts totaling 175BP and a mild recession in 2024: Deutsche ...

The Fed's Message: A Shift in Monetary Policy

The Fed's decision to send this message now is not surprising, given the current state of the economy. With inflation remaining stubbornly low and economic growth showing signs of slowing, the Fed is under pressure to act. The central bank's dual mandate is to promote maximum employment and price stability, and with the labor market nearing full employment, the focus is now on inflation. The Fed's message suggests that it is preparing to take steps to support inflation and ensure that it reaches its target rate of 2%.

What Does This Mean for Interest Rates?

A rate cut would have significant implications for consumers and investors. For borrowers, a lower interest rate would mean cheaper borrowing costs, making it easier to take out loans and mortgages. For investors, a rate cut would likely lead to a rally in the stock market, as lower interest rates make stocks more attractive compared to bonds. However, a rate cut would also have implications for savers, who would see their returns on deposits and savings accounts decrease.

Stay tuned for further updates and analysis on the Fed's interest rate decision and its implications for the economy. With the countdown underway, it's essential to be informed and prepared for what's to come.